Taxation system in Pakistan has become the focal point concerning national revenues as well as national economical planning. Two of the most talked about areas with respect to this framework are direct tax and indirect tax, which have different implications on individuals and businesses as well as the economy. The two types of taxation are completely different in the way they are enacted and changed and it is important to understand their roles in estimating their social and economic consequences.

The new changes that Pakistan has been introducing on the fiscal front have been to ensure a better balance between the two, as the nation strives to enhance equity and enlarge its tax base, and decrease its fiscal deficits. This paper will discuss the nature, efficiency and issues of the two kinds of taxes with reference to the present day in Pakistan.

The Role of Direct Tax in Pakistan

Income-Based Taxation and Legal Framework

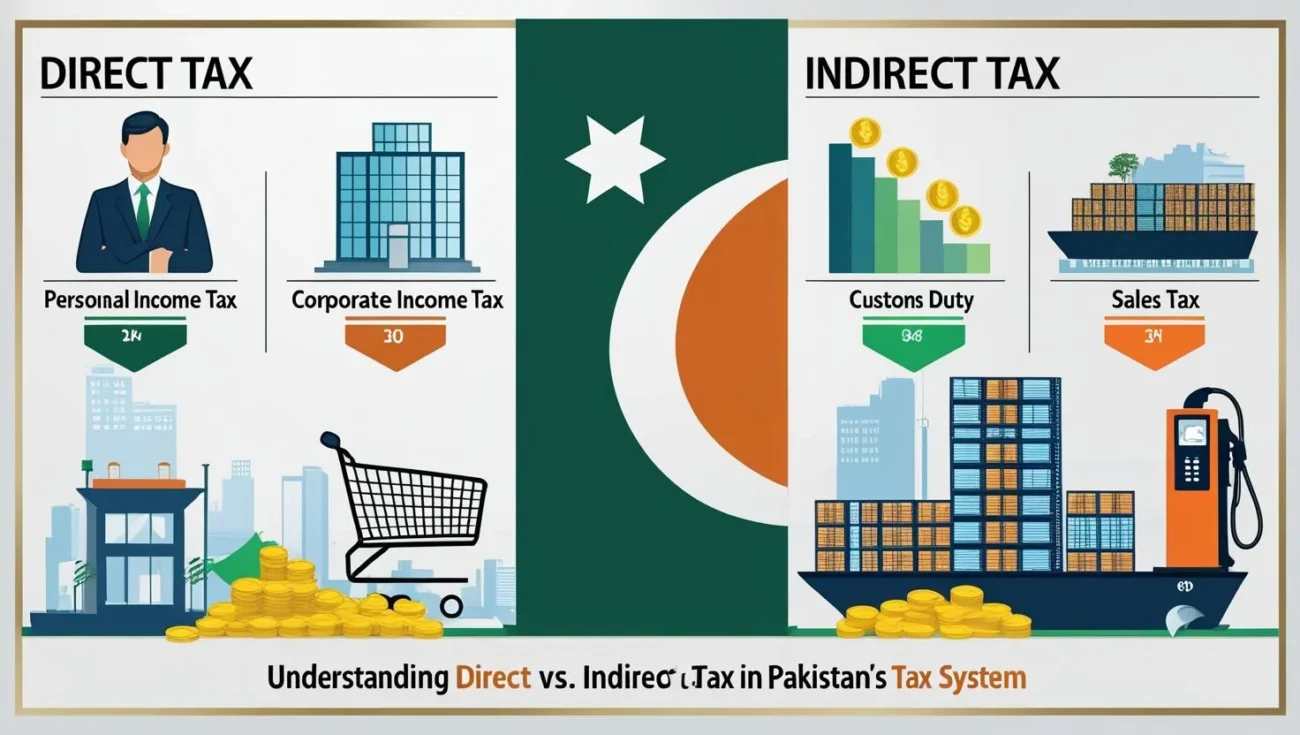

Direct tax consists of the taxes charged against the income or profits made by the individuals or businesses. The structure comprises personal income tax, corporate tax, capital gains tax, and wealth tax. These taxes in Pakistan are governed by the Income Tax Ordinance of 2001, which provides the legal basis for their implementation. Direct taxes are counted on to contribute a larger percentage over the years and this can mainly be attributed to the reduction of inequality in income as well as the promotion of financial discipline.

Progressive Tax Structure

In Pakistan, the more money a person earns, the higher the percentage of tax they have to pay. This is called a progressive income tax system. People who earn more than particular limits are subject to higher taxation rates, and some of the brackets rise to 40%. This system of taxes is meant to see the one having more capacity to pay carry the heavier taxes.

Withholding Tax and Corporate Revenue

Another important element of direct taxation scheme is withholding tax. It makes it possible to implement collection at the source, prior to when they receive revenue or engage in some financial activities. Unlike other taxes, that require a dedicated effort of collection, this tax is managed by banks, by employers, and by other financial institutions, as they are charged with the task of deducting the tax against salaries, payments, and withdrawals, hence a reliable way of collecting tax.

The government also earns money from other taxes like capital gains tax, which is charged when someone makes a profit by selling property or shares. Corporate income tax represents another essential element, imposed on the net profits earned by businesses. Collectively, these instruments constitute the core structure of Pakistan’s direct taxation system.

The Nature and Impact of Indirect Tax

Tax on Consumption of Goods and Services

Indirect taxes, as opposed to direct taxes, are embedded in the pricing of goods and services. They are not charged on income or profit, but instead on the things people buy. When it comes to indirect taxes in Pakistan, the most common ones are sales tax, customs duty, and federal excise duty.

Types and Collection Authorities

Both the provincial and federal governments are the beneficiaries of sales taxes charged on the majority of goods and services. It can be charged at different sums, but on average, many products are subjected to its 18% when it comes to manufacturers of products. The importation of commodities is subjected to customs duty that safeguards local production and excise duty on limited items such as fuel, tobacco, and luxurious goods.

Regressive Nature and Its Consequences

A major issue of concern with regard to such a form of taxation is that it is regressive in nature. Because it affects every consumer proportionate irrespective of his/her income level, lower-income households tend to bear a disproportionate burden. This has the potential of causing more poverty and loss of purchasing power to the most susceptible groups in society.

The Shift Toward Equitable Taxation

Declining Dependency on Indirect Revenue

Practically speaking, indirect taxes have accounted for the largest share of Pakistan’s total revenue, occasionally surpassing the 60% mark. Economists and social experts have been criticising this over-dependency as a factor that has increased the distance between the rich and the poor. Nevertheless, the trend has changed as of recent fiscal years; the percentage of direct tax has been on the upswing.

Recent Reforms and Revenue Patterns

Direct tax has an upward trend in contribution of revenue to the government as compared to years past because in the 2024–25 fiscal years, it contributed almost 49 percent of the total revenue. The reforms that explain such a change are tightening enforcement, personal and corporate tax rate increase, and advancing higher tax tally. Although the indirect tax remains critical, it seems that the government is determined to balance the situation.

Influence of Global Financial Institutions

International financial institutions have also been able to contribute to this rebalancing effort where they prescribe increased direct tax to be based as a fairer method to finance government expenditure. Following this suggestion, Pakistani tax collectors have increased online utilization, enhanced control of compliance, and stricter punishments of tax evasion.

Socioeconomic Effects of Taxation Types

Equity Through Income-Based Taxation

Taxation has massive effect on the society. Direct tax is inclined to encourage equity, and this is particularly when well applied. It gives the government the capability to impose revenue on the individuals with stronger incomes and disperse it using welfare programs, infrastructure developments, and subsidies on basic services. But issues such as tax evasion, underreporting of income and a low tax base have been the hurdles which have limited its possibilities in Pakistan in the past.

Burden of Consumption-Based Taxes

Conversely, the prominent application of an indirect tax will mean a steady flow of revenue without taking much toll on the people who need it the least. Those that are not a member of the formal economy, pay taxes that are to some extent based on their consumption. With no exemptions on basic products and services, inflation and tax-related increase in prices have a direct effect on the low-income residents.

Informal Economy and Compliance Challenges

Another big challenge is Pakistan’s large informal economy. Indeed, a large number of workers and firms do not enter into the formal financial channel and, therefore, are beyond the scope of income-centered taxation. They may not pay much or anything in direct tax yet they pay indirect tax in acquiring goods. This segment is another aspect that presents a significant policy challenge to ensure its inclusion into the tax net.

Reform Initiatives and the Road Ahead

Digitalization and Structural Enhancements

Pakistan has engaged in a number of reforms that are meant to enhance its taxation regime. These involve computerization of tax records, ease in filling, and widening of the number of taxpayers who are registered. Increasing tax on the non-filers and encouraging regular filers of tax is one of these measures to increase compliance. Additionally, increased levies and responsibility of the tax institutions are also being discussed to be more transparent and efficient.

Rationalizing Tax Types for Growth

To have a long-term economic stability, it is clear that the direct tax base needs expansion. It minimises reliance of fluctuation in consumption and promotes sustainable growth. In the meantime, indirect tax can be rationalized by focusing on luxuries but not necessities and in this way can cushion the poor whilst simultaneously ensuring the required income is raised.

Strategic Goals Beyond Revenue

Another consideration by the policymakers is that taxation should help to achieve greater economic objectives like investment, employment opportunities as well as poverty alleviation. It may succeed to a great extent by adopting a fair and balanced tax structure where direct tax would be the backbone and indirect tax would be used sparingly.

Conclusion: Toward a Balanced and Fair Taxation Model

Changing taxation system in Pakistan is an indication of what Pakistan is facing; the need to balance taxation against economic justice. Indirect tax is one of the most significant segments of the fiscal policy, but its regressive character indicates that there is a necessity to implement the more fair representation. Direct tax contributes very little to the tax base and that is why there is a need to increase its share and efficiency towards a more equitable, more inclusive economy.

As a result of reforms, enforcement, and trust-building with its population, Pakistan has started it on the path of cutting its consumption-based taxation dependency. The way ahead necessitates not simply enhancing the levels of fulfilment of the tax levies but also to make tax collection an instrument of national building and social prosperity. The right combination of direct tax and indirect tax is not only a fiscal necessity something that can be conducted most successfully, but it is also a fundamental principle in sustainable governance.