FBR Income Tax Return is something that becomes not only legal for businesses and people able to provide such documents, but also represents an opportunity to become a better citizen of the country in Pakistan. The Federal Board of Revenue (FBR) is the governmental authority that handles the issue of taxation in the country including collection of income tax and the verification of tax records in the country. Are you a salaried, a business owner or a property investor? Filing your FBR Income Tax Return not only makes the law when it comes to your taxes, and makes you eligible to access various financial perks that you get to enjoy.

Importance of Filing FBR Income Tax Return

The benefits are enormous to filing your FBR Income Tax Return as opposed to not filing the return and being penalized. Actively paying taxpayers have low rates of withholding tax imposed on a number of transactions including purchase of properties, vehicle registration or bank transactions. It also increases credibility when it is time to apply visas, tenders or get loans. In addition, the status of FBR tax return status is an indication of your compliance record, failure of which is likely to keep you among the past taxpayers which is not allowed to enjoy these benefits.

Becoming a Tax Filer in Pakistan

A tax filer in Pakistan is defined as a person or entity whose name appears in the Active Taxpayers List (ATL) maintained by the Federal Board of Revenue (FBR) You are required to file your FBR Income Tax Return within the due date in order to be put down as a “filer”. The inability to do so not only contributes to the increased level of taxes deduction but also limits the access to some of the legal and financial benefits. It may be tricky to a first-time filer, and that is why, to some individuals, hiring the services of professional tax preparers is a good idea as they guarantee perfection and conformity.

Land Record Punjab and Professional Tax Return Services

Land Record Punjab focuses on giving you professional, dependable, and speedy tax related services to assist you to file your FBR Income Tax Return with ease. We offer our clients a step-by-step procedure that will take them through appropriate and required documentation to the completion process. Our staff makes sure that not only are you filing your return properly, but that you are an active filer without the fear of those avoidable delays. Accessing our services is one way of saving time, legal mistakes, as well as complete compliance with FBR requirements.

Checking FBR Tax Return Status Online

Once your FBR Income Tax Return has been submitted, then you should check your FBR tax return status. This will be possible via the internet on the official FBR portal. It reflects on the system on whether your returns have been received, successfully processed or not. You should keep up-to-date with your tax return status so you don’t get any unpleasant surprises last minute and to make sure your name remains secure in the ATL. In our organization, Land Record Punjab, we give full information on how to check and diagnose your status, so there is no need to worry to our customers.

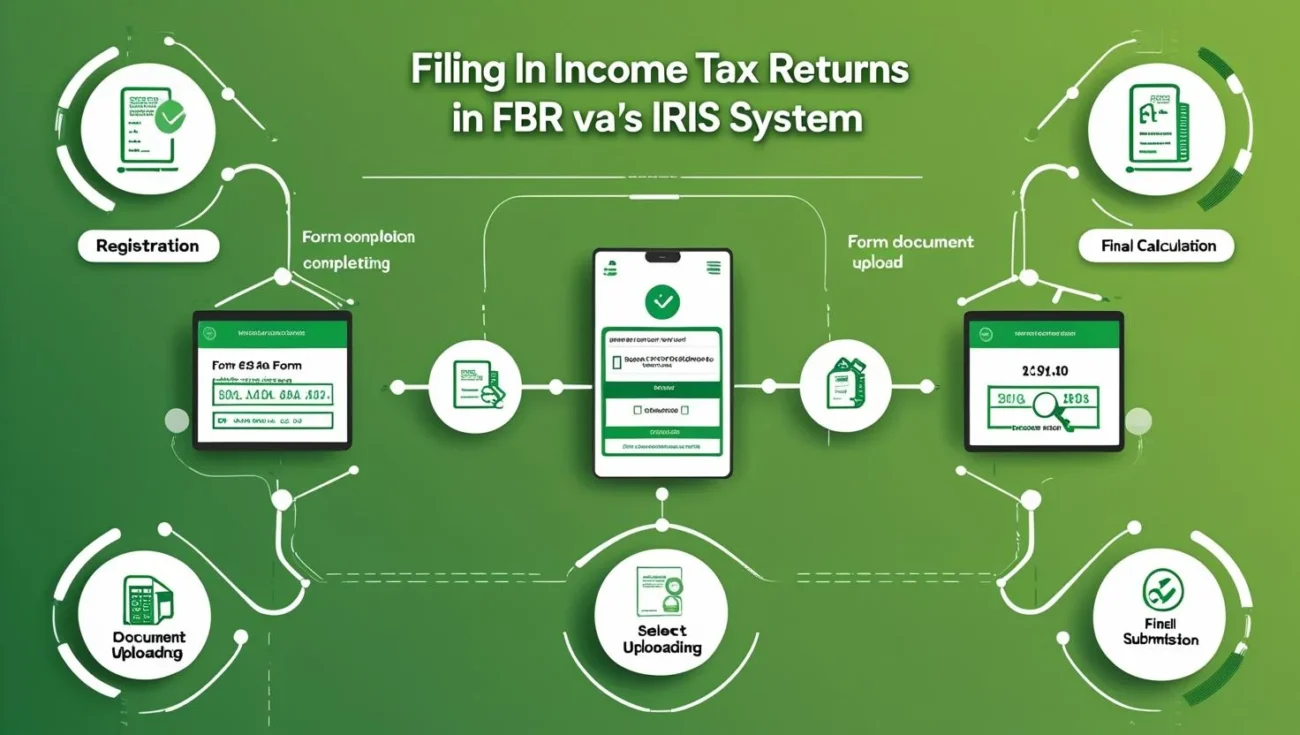

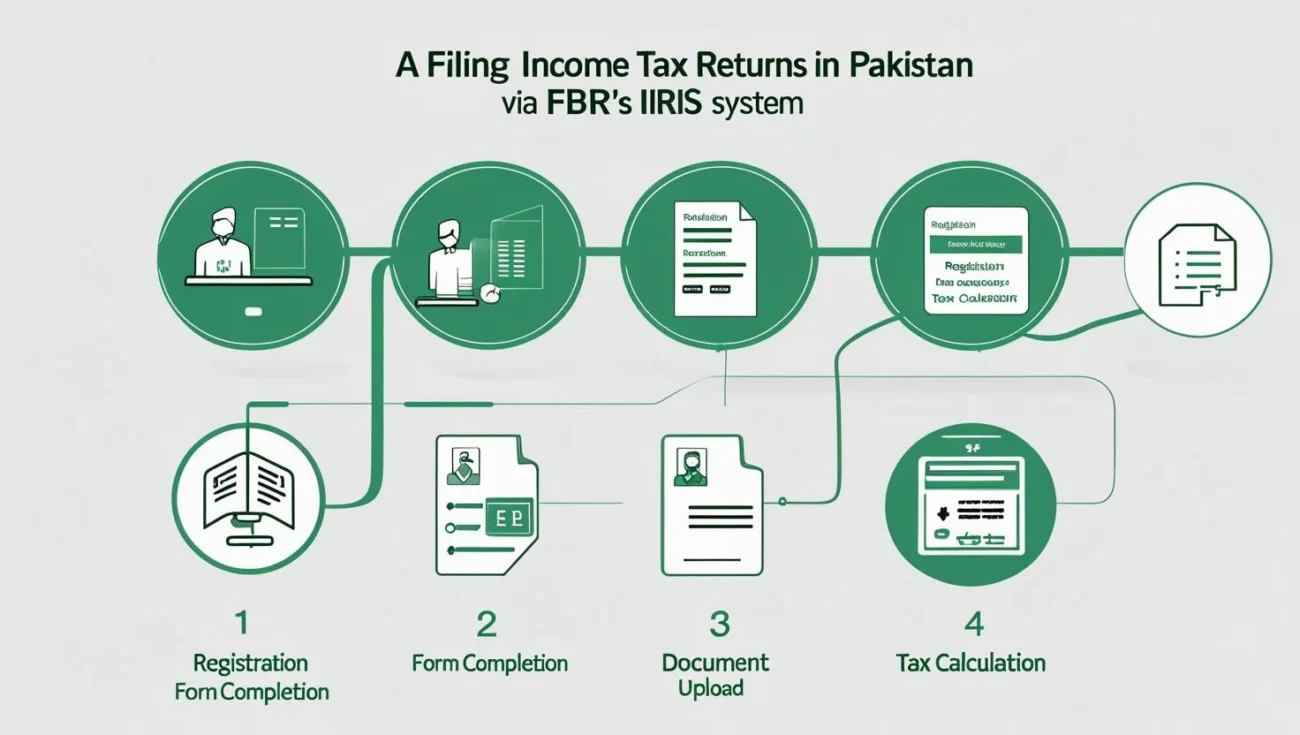

Procedure for Filing FBR Income Tax Return

There are multiple steps in preparation of FBR Income Tax Return. The first thing is to log in to your FBR account by entering your CNIC. Then the preparation of the return is made by asserting your income, expenses and assets and liabilities of the tax year. This is submitted online into the online IRIS of the FBR. Once the process of submission is complete your FBR tax return status is updated with respect to the process of returning. This might sound easy but most people find it hard to decipher the actual format and requirement, hence the value of such services as Land Record Punjab.

Advantages of Active Tax Filer Status

The Pakistani tax system allows an active taxpayer to get the reduced tax rates in terms of property transactions, bank withdrawal money, and vehicle registration. As an illustration, at the point of acquisition of real estate or the sale of a car, the non-filers end up paying very high taxes. Also, to receive government tenders or business contracts, or even some foreign travelling, one needs to demonstrate the filer status. Our formal help at Land Record Punjab means that as well as filing your FBR Income Tax Return to your deadline, you will keep your status as an active filer throughout the year.

Challenges in Filing FBR Income Tax Return

Among the factors that hinder most people in filling the FBR Income Tax Return effectively is the technical expertise that should be used to declare income dispensed by different sources. Most individuals are also not knowledgeable on the deductions, exemptions or credits that they can claim. Failure to file accurately may subject one to notices, penalties or even auditing. Moreover, sometimes taxpayers are exposed to errors with the online system or uploading documents or finding a password. These are some of the difficulties that our clients can be relieved of at Land Record Punjab through professional help and the latest tax know-how.

Why Choose Land Record Punjab for FBR Filing Services

Opting Land Record Punjab allows you to cooperate with the team of professionals to make the FBR Income Tax Return procedure easier both to individuals and companies. We provide customised consulting service with a fast turnaround time and strict confidentiality of your financial information. With our experience in tax filing and legal documentation, we keep your filings correct, legal, and in line with your long-term financial objectives. Our services are customised to your demands whether you are a salaried employee, you are in business, or an investor who is interested in properties.

Final Thoughts on FBR Income Tax Return in Pakistan

However, in Pakistan, declaring FBR Income Tax Return is not simply a task that you need to complete, it is the process of protecting your financial status, and enjoying government incentives. Whether it is inquiry on the FBR tax return status or registering as an active tax filer in Pakistan, every step counts in establishing your tax record. By hiring the professionals of Land Record Punjab, it will be a flawless experience that will not make you fall out of regulation and carry all burdens. When you remain proactive on your taxes, you not only get yourself out of legal trouble, but also get the immense savings and opportunities in the future.